Fortuna Mining Looks to West Africa to Rebuild Gold Production Pipeline

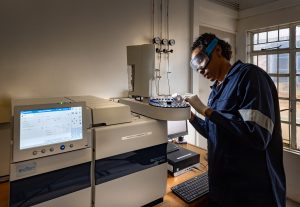

The Séguéla gold mine in Côte d’Ivoire. (Image courtesy of Fortuna Silver Mines.)

Fortuna Mining is sharpening its focus on West Africa as it seeks to restore annual gold production to around 500,000 ounces following the sale of higher-cost, short-life assets in Burkina Faso and Mexico.

The Canadian-listed precious metals producer exited the Yaramoko mine in Burkina Faso and the San Jose operation in Mexico earlier this year, a move aimed at improving portfolio quality but which reduced overall output. The company is now repositioning for growth through a combination of organic expansion and targeted acquisitions.

West Africa has emerged as the cornerstone of that strategy. Fortuna has entered new exploration partnerships, including a joint venture with DeSoto in Guinea, and has increased its ownership in Awalé Resources, an explorer with active projects in Côte d’Ivoire. The renewed push comes amid sustained strength in gold prices, which has accelerated dealmaking across the global mining sector.

According to David Whittle, Fortuna’s chief operating officer for West Africa, the company has a clear pathway to rebuilding production through expansions at its existing assets, particularly the Séguéla mine in Côte d’Ivoire and the Diamba Sud project in Senegal. At the same time, Fortuna continues to evaluate acquisition opportunities that could fast-track growth.

The company is targeting mid-tier gold operations capable of producing between 100,000 and 200,000 ounces per year, with mine lives of at least a decade. Management has indicated that any potential transaction must be value-accretive rather than purely volume-driven. Fortuna currently holds approximately $400 million in net cash to deploy if suitable opportunities arise, with a preference for jurisdictions where it already operates.

Séguéla remains central to Fortuna’s growth ambitions. The mine, which achieved first gold in 2023, has reported significant resource growth, including an 11% increase in contained reserve ounces, a doubling of indicated resources and a 15% rise in inferred resources compared with estimates published in December 2024.

Production at Séguéla is expected to surpass company guidance in 2025, with output forecast to exceed 150,000 ounces. Fortuna has commissioned engineering group Lycopodium to assess options to increase processing plant throughput to between 2.0 and 2.5 million tonnes per annum, up from the current 1.7 to 1.75 million tonnes.

The company’s expansion efforts coincide with a broader wave of consolidation in West Africa’s gold sector. Recent transactions include Atlantic Group’s acquisition of Barrick Mining’s Tongon mine in northern Côte d’Ivoire, as well as the merger of African Gold and Montage Gold.

In a further sign of intensifying competition for quality assets, Perseus Mining’s A$2.1 billion takeover bid for Predictive Discovery recently fell through after Robex Resources presented a higher offer for the Guinea-focused explorer, highlighting the impact of record gold prices on global mining consolidation.

Share this content: