Rio Tinto-Backed Sovereign Metals Secures IFC Support for Malawi Graphite Development

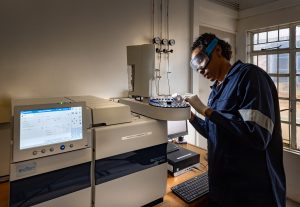

(Photo: Kaiya project. Source: Sovereign Metals | Twitter.)

Australia-based Sovereign Metals has entered into a strategic agreement with the International Finance Corporation (IFC), the private-sector arm of the World Bank Group, to support the development of its Kasiya rutile-graphite project in Malawi.

Under the agreement, the IFC is expected to provide financing for the graphite component of the project should Sovereign Metals move ahead with construction funding. The partnership strengthens the project’s financial and institutional backing as global demand for critical minerals continues to accelerate.

Sovereign Metals counts Anglo-Australian mining major Rio Tinto as a significant shareholder, with Rio Tinto holding an 18.45% stake in the company, according to LSEG data. The involvement of both a global mining major and a multilateral development finance institution underscores growing international interest in Malawi’s emerging role within the global critical minerals supply chain.

The Kasiya project is positioned as a globally significant asset. Sovereign Metals describes it as the world’s largest rutile deposit and the second-largest graphite deposit, placing Malawi at the centre of two strategically important mineral markets used in advanced manufacturing, clean energy and defence-related supply chains.

The partnership comes as Western governments and industrial players intensify efforts to secure alternative sources of critical minerals, seeking to diversify supply away from China amid persistent supply chain vulnerabilities and rising geopolitical and trade tensions.

Graphite is a key input in rechargeable lithium-ion batteries used in electric vehicles and energy storage systems. It is currently included on the draft US Geological Survey list of minerals considered critical to the United States’ economic and national security interests.

For Malawi, the Kasiya project represents a potential anchor development capable of attracting long-term foreign investment, supporting export diversification and strengthening the country’s participation in global battery and clean energy value chains.

Share this content: