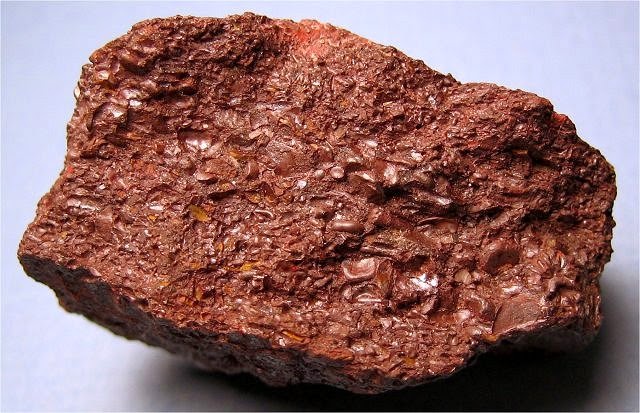

Iron-ore prices to remain resilient – Fitch

Research firm Fitch Solutions Country Risk and Industry Research, which is a unit of Fitch Group, has maintained its iron-ore price forecast at $85/t for this year, as prices remain resilient compared with other metals on the back of the Covid-19 pandemic.

The firm says stronger Chinese steel production in the second half of the year is likely to further boost demand for and prices of iron-ore.

On the supply side, Fitch Solutions Country Risk and Industry Research’s outlook remains largely supportive of prices.

From a demand perspective, globally, India is expected to be a bright spot for iron-ore demand growth as domestic steel production continues to accelerate.

Meanwhile, demand from the US and South Korea is expected to remain subdued owing to stagnant steel production growth.

Fitch Solutions Country Risk and Industry Research has raised its price forecasts for iron-ore to average $90/t in 2021 and $85/t in 2022. This is aligned to its revised forecasts for China’s real gross domestic profit growth and construction industry value growth to accelerate in 2021 following a weak 2020.

The firm cautions, however, that downside risks to its current view of iron-ore prices holding up in 2020 are highly pronounced, owing to significant risks to the Chinese economy that may hamper physical, as well as investor sentiment.

Share this content:

Post Comment