Blue Gold Secures $140M to Restart Ghana Gold Mine

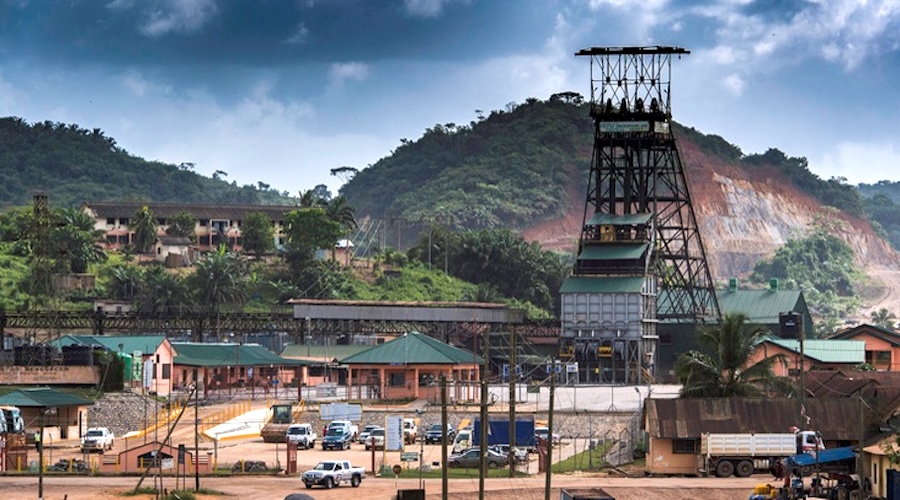

Bogoso Prestea gold mine. (Image courtesy of Ghana’s State Interests and Governance Authority — SIGA.)

Blue Gold has secured a fresh $65 million commitment from an undisclosed institutional investor, bringing total pledged capital to $140 million to restart operations at the Bogoso-Prestea gold mine in Ghana. The announcement sent Blue Gold’s shares up as much as 9.6% on the news, even as the company’s market capitalisation stands at $194 million following a year-to-date decline of roughly 45%.

The funds are being held in escrow while a mining lease dispute with the Ghanaian government is resolved. Blue Gold has indicated a willingness to drop ongoing litigation if the issue is settled promptly. Chief executive Andrew Cavaghan said the new financing, combined with previously committed amounts, demonstrates the company’s ability to invest in bringing the mine back into full production.

Restarting Bogoso-Prestea aligns with Blue Gold’s broader strategy to digitise and monetise its output. The company plans to convert mined gold into a gold-backed digital currency through its new digital division, positioning the initiative as a pioneering global, gold-backed payment solution.

The underlying lease dispute dates to September 2024, when actions by Ghana’s previous government resulted in the termination of mining leases on grounds related to unpaid wages. Blue Gold challenged those actions and says the matter is now before international arbitration. The company remains optimistic about reaching a settlement that will allow operations to resume and restore the mine’s contribution to production.

Share this content: