PIC Boosts Stake in Sibanye-Stillwater, Reinforcing Commitment to South Africa’s Mining Sector

Johannesburg, 15 October 2025 — South Africa’s Public Investment Corporation (PIC) has increased its equity stake in Sibanye-Stillwater by 2.35%, bringing its total holding to 20.42% and solidifying its position as the mining group’s largest shareholder.

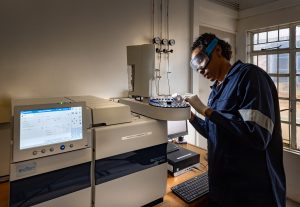

The move underscores PIC’s growing commitment to South Africa’s resource sector. With over R3 trillion ($155.6 billion) in assets under management as of September 2025, the state-owned asset manager has recently announced plans to invest R1.35 billion in early-stage mining ventures, with at least half of that earmarked for domestic projects focused on energy transition minerals such as copper and lithium.

Founded in 2013, Sibanye-Stillwater is a global mining and metals processing company operating across five continents. It specializes in the production of platinum, palladium, rhodium, and gold, and is also active in refining chrome, cobalt, copper, iridium, nickel, and ruthenium. The company has expanded its footprint in metal recycling and mine tailings retreatment.

In July, Sibanye-Stillwater acquired U.S.-based Metallix Refining for R1.45 billion ($105 million enterprise value), a strategic move aimed at enhancing its global recycling capabilities and technological expertise. Metallix is known for recovering precious metals from industrial waste streams.

Leadership at Sibanye-Stillwater also saw a transition this month, with Richard Stewart stepping into the role of CEO following the retirement of Neal Froneman, who led the company for 12 years.

PIC’s increased stake and Sibanye-Stillwater’s strategic acquisitions signal a renewed focus on sustainability, innovation, and long-term growth in South Africa’s mining industry.

Share this content: