Ghana Launches Sweeping Mining Audit to Curb Revenue Loss and Smuggling

Ghana, the continent’s leading gold producer, has initiated its most comprehensive mining audit in a decade, targeting major operators in a bid to stem revenue leakage and clamp down on smuggling. The audit, announced in an October 13 letter from the Minerals Commission, signals a decisive regulatory shift as the government seeks to capitalise on record-high gold prices and reinforce fiscal oversight.

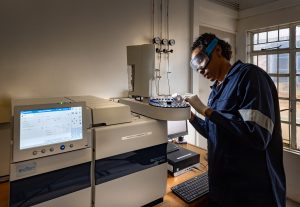

The audit will scrutinise production volumes, mineral flows, tax and royalty compliance, and environmental practices across the country’s top mining operations. Companies including Newmont, AngloGold Ashanti, Gold Fields, Perseus, Asante Gold, and China’s Zijin have been instructed to submit ten years of production data, three years of financial records, permits, stockpile inventories, and shipping manifests. The phased audit begins in November 2025 with Gold Fields’ Damang mine and Perseus, concluding in June 2026 with Xtra-Gold’s Kibi unit.

This initiative comes amid a broader regional trend in West Africa, where governments are tightening mining oversight to ensure fair returns from booming commodity markets. Ghana’s mining sector generated 17.7 billion cedis (US$1.68 billion) in 2024, buoyed by a 25.1 percent surge in gold output. The country anticipates gold production to reach 5.1 million ounces in 2025, up from 4.8 million the previous year.

The last sector-wide audit in 2015 faced resistance from some companies, but the current effort is backed by forensic accountants, independent consultants, and government auditors. The government is also pursuing reforms to shorten licence durations and mandate direct revenue-sharing with host communities, aiming to enhance transparency and local benefit.

As the audit unfolds, its findings could reshape the regulatory landscape and set a precedent for mining governance across the region.

Share this content: